Tag: Australia

-

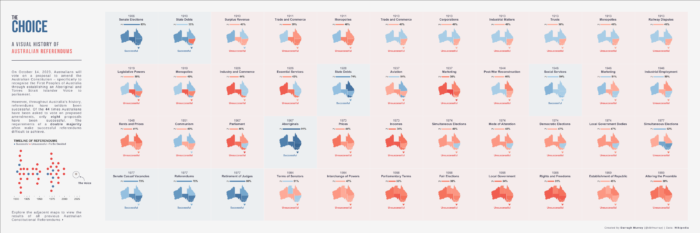

Iterative Visual Design and The Choice Visual

Early last month, I published a series of new Tableau Public visualisations on the history of referendums in Australia, immediately prior to the latest Australian referendum vote on recognising Indigenous Australians in our constitution – commonly known as the referendum on The Voice to parliament (unfortunately, the vote failed but I’m not going to delve…

-

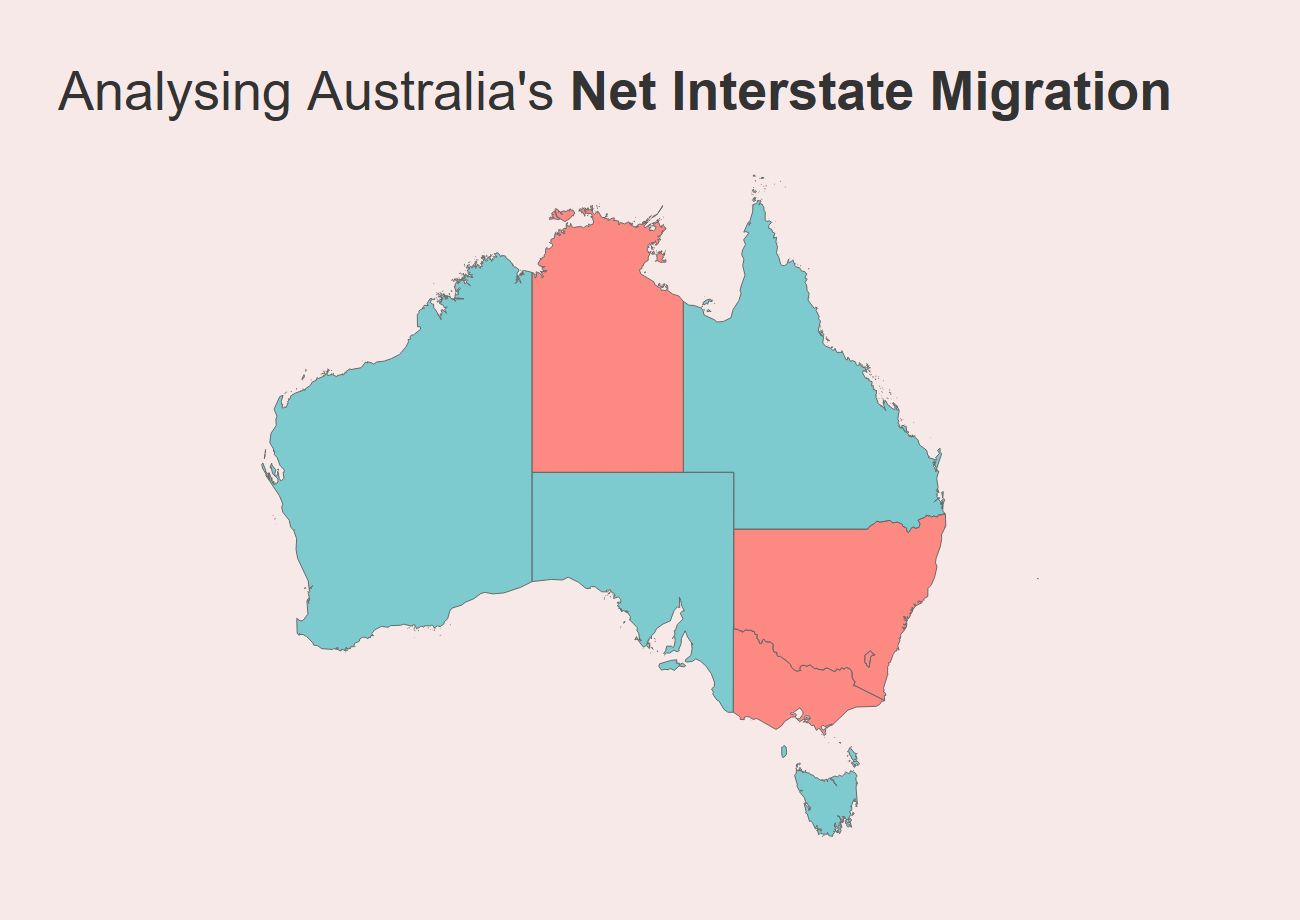

Analysing Interstate Migration Movements in Australia

I recently published a dashboard to allow people to view Australian interstate migration figures using ABS data. As I mentioned in the post introducing the dashboard (which you can read here), interstate migration became a hot topic throughout the first two years of the COVID-19 pandemic. We witnessed en-masse movements of Australians throughout the country…

-

A new take on international education student enrolment data by region: Experimenting with Tableau mapping

The Department of Education, Skills and Employment provide the international education sector in Australia with a large amount of very useful data on international students studying within our borders. Much of it is provided in a number of formats – from pivot tables made available through Austrade’s Market Information Package to a range of data…

-

The Data Game: Building Analytics Capability in International Education

[Originally published by IEAA’s Vista Magazine (Summer 2016/17) — I’d strongly recommend following them online and reading their publications if you’re interested in Australian international education!] Embracing an analytic mindset and capitalising on the technologies in the era of big data are key to reaching Australia’s strategic international education goals, writes Darragh Murray. A tale of prediction…

-

Australian international education market performs well in ICEF agent barometer

The ever comprehensive ICEF Monitor has published some early results from their eight annual agent barometer survey (co published with iGraduate). Given the lifting on the ban on foreign agents in US institutions, it is perhaps not unexpected that agents would be referring more students to US institutions – the barometer reports that 80% of…

-

Internships, work experience needed for international students in Australia

A recent report into graduate opportunities for international students within Australia argues that in order to be competitive with domestic graduates, international students coming out of Australian institutions need to gain far more practical and work-ready skills in order to compete. Joint research between Deakin University and UTS, Australian International Graduates and the Transition to…